Grow Smarter, Not Bigger

Rethinking Workforce and Revenue Strategy

Overview

This case study helps tech executives determine whether growing revenue is better achieved by expanding the workforce or improving productivity. With rising labor costs and widening global efficiency gaps, the central question is: do more employees lead to more revenue, or can lean, high-performing teams achieve more with less?

It also examines where companies should consider relocating to optimize workforce efficiency. By comparing revenue output across companies, countries, and regions, the analysis identifies where labor is best converted into growth. These findings support smarter decisions on hiring, automation, and global expansion.

Executive Summary

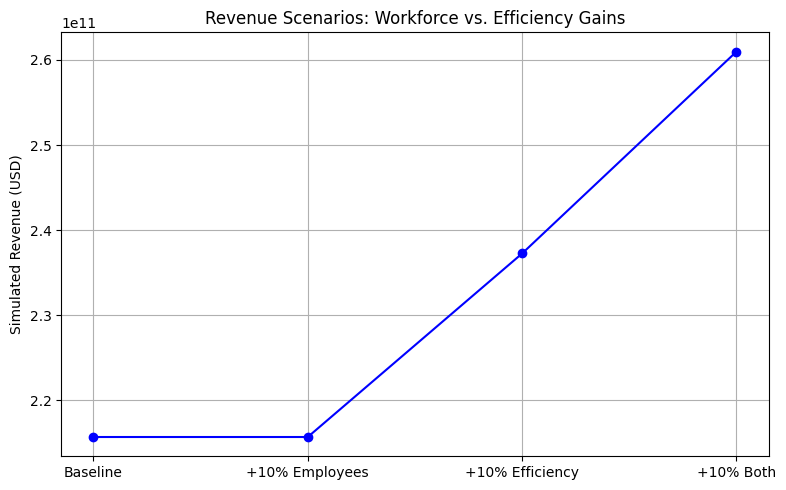

Productivity gains offer the same revenue impact as hiring more people—but at lower cost. A 10% efficiency boost yields a similar return as a 10% headcount increase. When combined, the result is a 21% revenue uplift. This makes efficiency-focused strategies more cost-effective. Moreover, relocating to high-performance regions like North America, South Korea, or Hong Kong further amplifies these gains.

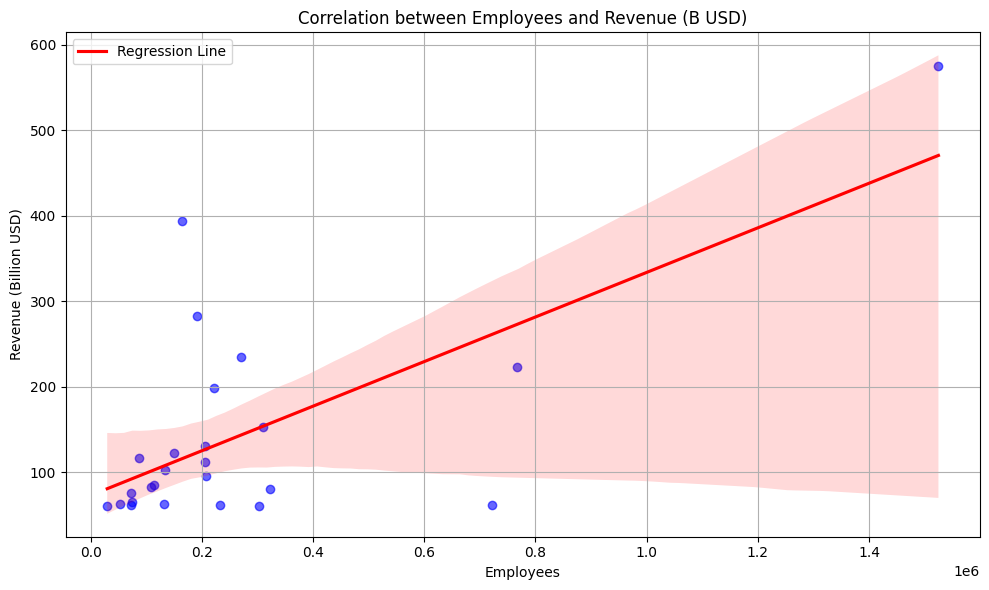

1. Do more employees drive more revenue?

Yes, but not always efficiently. A correlation coefficient of 0.676 shows a moderately strong relationship between employee count and total revenue. However, companies like Apple and Nvidia generate high revenue with leaner teams, while others like Amazon and Foxconn require much larger workforces. This suggests that while headcount plays a role, business model and workforce efficiency are equally important.

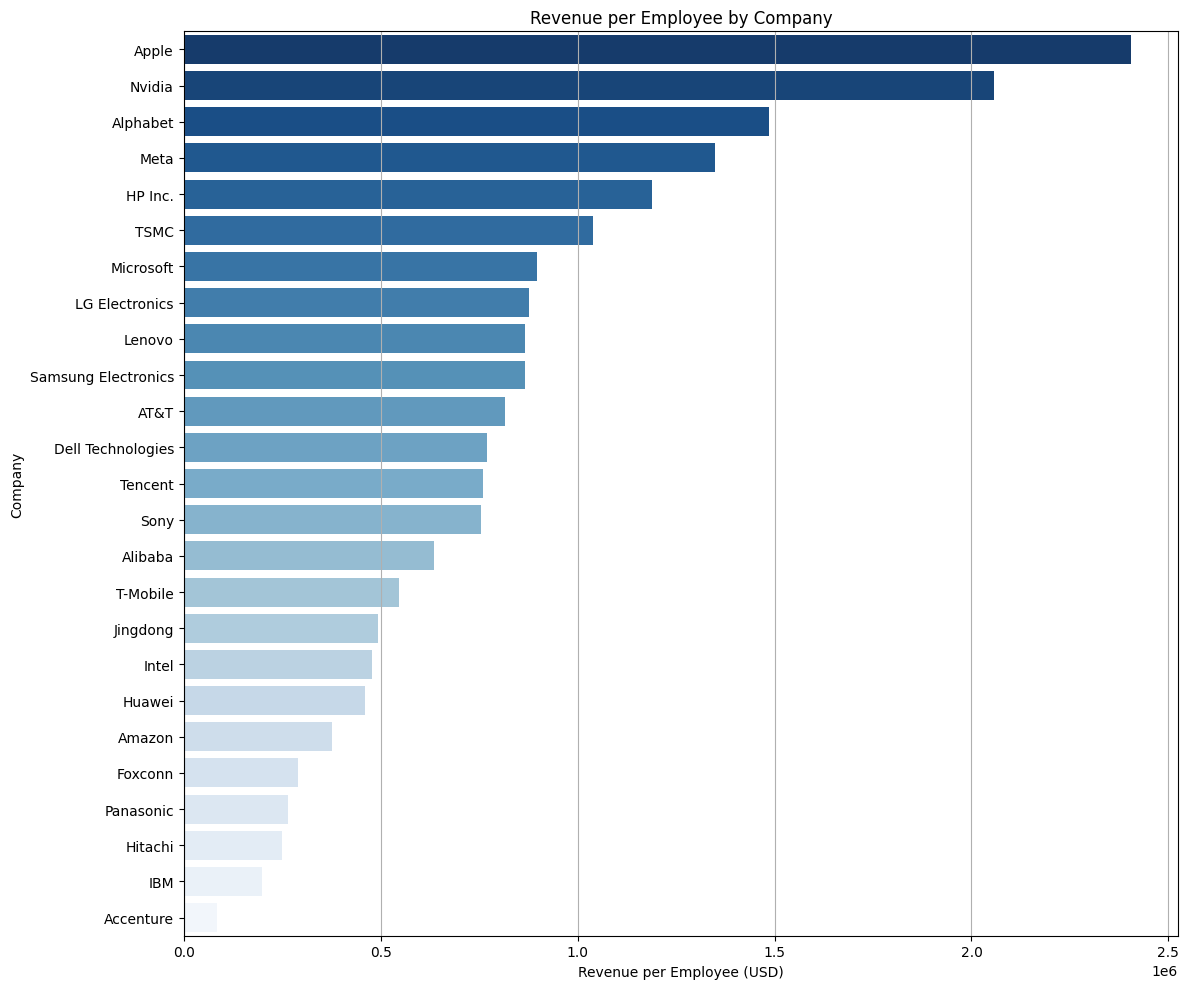

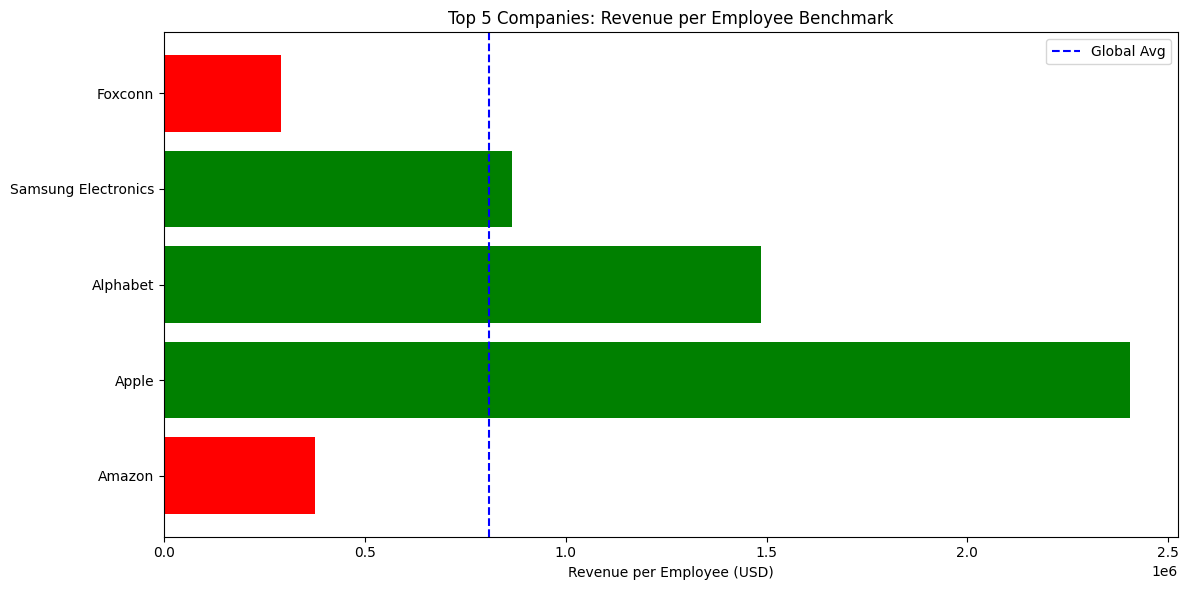

2. Which companies lead in efficiency?

Beyond total revenue, Apple ($2.4M), Nvidia ($2.06M), and Alphabet ($1.49M) lead in revenue per employee, far exceeding the estimated average of $850K. In contrast, Amazon ($376K) and IBM ($199K) fall well below, highlighting opportunities for performance improvement.

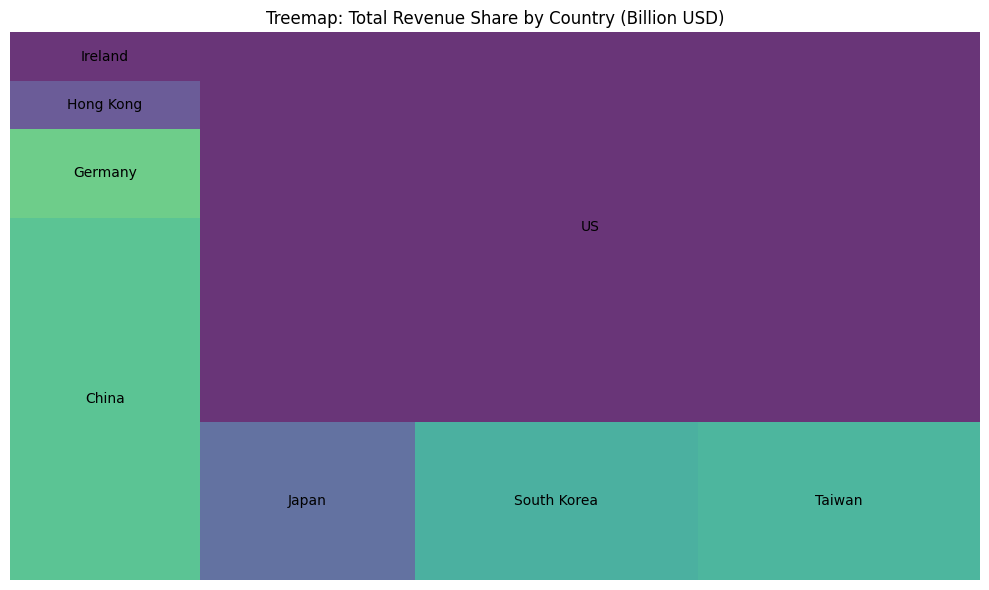

3. Are some countries more efficient than others?

Yes. Companies headquartered in the US ($1.09M), South Korea ($871K), and Hong Kong ($866K) show the highest revenue per employee. In contrast, Ireland, despite having the largest average workforce, records just $85K per employee, signaling underperformance.

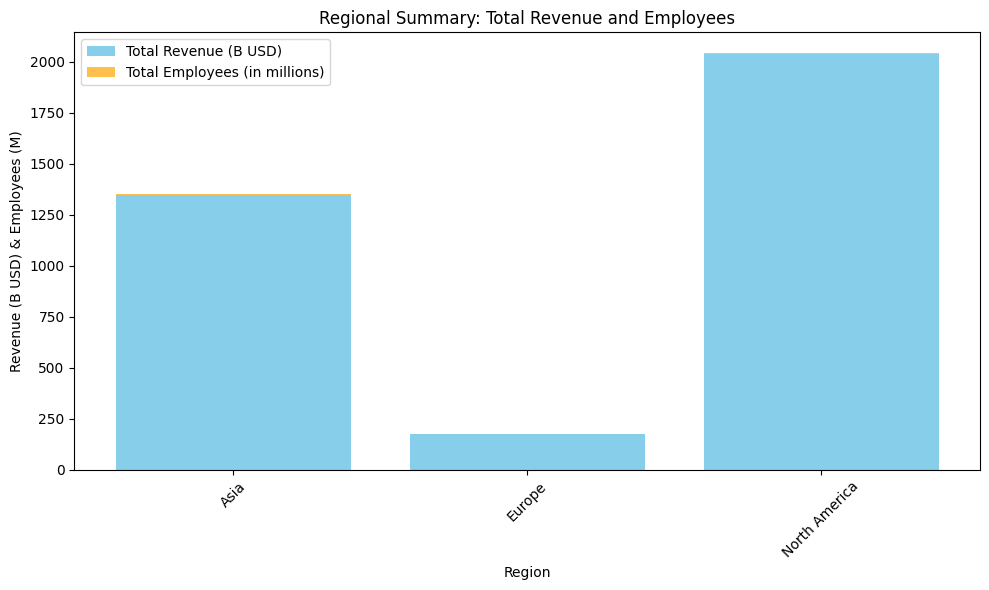

4. Are there regional differences in output?

These country-level trends extend to regional patterns. North America leads in efficiency at $683K per employee, followed by Asia at $489K. Europe lags significantly with just $187K, despite having mid-sized workforces. This suggests that location impacts both cost and output, not just scale.

5. How do top-revenue companies compare in efficiency?

Among the top 5 revenue-generating firms—Amazon, Apple, Alphabet, Samsung, and Foxconn—only Apple and Alphabet achieve high efficiency with relatively small teams. Samsung performs well with a mid-sized team. In contrast, Amazon and Foxconn depend on scale rather than efficiency, falling below the average in revenue per employee.

6. Should we hire more or improve productivity?

Both strategies yield similar short-term gains of about 10%, but improving productivity is more cost-effective as it avoids additional labor costs. When both approaches are combined, revenue increases by ~21%, demonstrating that growth is strongest when headcount expansion is supported by process optimization. For most companies, this means starting with automation, training, and smarter resource allocation.

Where should we relocate to grow revenue more effectively?

North America is the most efficient region, with firms generating $683K per employee. South Korea and Hong Kong also offer high revenue output with smaller teams, making them attractive for companies aiming for lean operations. Meanwhile, Europe, and especially Ireland, shows low productivity despite high staffing levels.

For companies seeking to scale intelligently:

- Choose North America to combine scale with high output.

- Consider South Korea or Hong Kong to maintain efficiency with fewer employees.

In short, grow smarter before growing bigger—and grow where efficiency already exists.