Maximizing Revenue with Data-Driven Price Adjustment for Skincare Products

This case study uncovers how strategic price adjustments can boost profitability without sacrificing sales volume. By leveraging predictive modeling, we identify which top-selling skincare products can sustain a price increase while maintaining demand. The insights offer a clear roadmap for skincare retailers to optimize pricing, enhance margins, and stay competitive in a dynamic market—ultimately driving revenue growth with precision and confidence.

Executive Summary

This case study examines sales volume prediction and pricing strategy evaluation for skincare products, focusing on how price and margin adjustments impact sales. A linear regression model was developed to predict sales volume with a Root Mean Squared Error (RMSE) of 270.71, demonstrating high accuracy in predictions. The analysis identifies key products that can sustain price increases while maintaining or increasing sales volume, providing actionable insights for strategic pricing decisions.

Problem Statement

The skincare retailer aims to identify which of their top-selling products can sustain a 10% price and margin increase without significantly reducing demand. By understanding price sensitivity, the retailer can optimize pricing and margins to enhance profitability.

Approach

A linear regression model was developed to predict sales volume for skincare products, with an RMSE of 270.71, indicating minimal prediction error relative to the average sales volume of 93,938 units. The analysis focused on the top five best-selling skincare products, examining the impact of a 10% price and margin increase on sales volume, as well as comparing post-increase prices with competitors.

Results

Top Five Best-Selling Products by Predicted Sales Volume

- Neutrogena Hydro Boost Gel: 98,635 units

- Eucerin Advanced Repair Lotion: 95,542 units

- Drunk Elephant Vitamin C Serum: 91,308 units

- Cetaphil Gentle Cleanser: 87,281 units

- Bioderma Sensibio H2O: 80,399 units

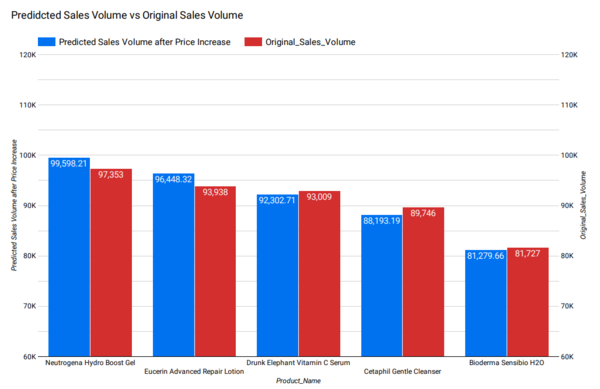

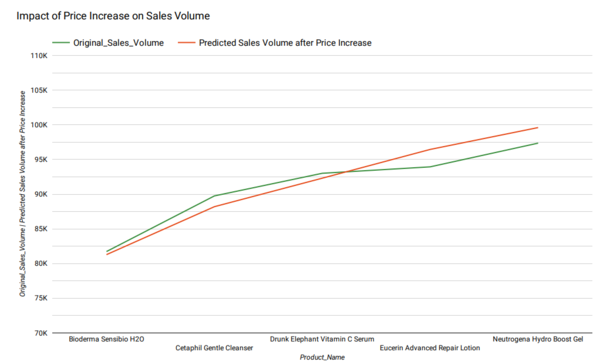

Impact of 10% Price and Margin Increases on Sales Volume

Neutrogena Hydro Boost Gel and Eucerin Advanced Repair Lotion are expected to increase in sales volume despite a 10% price and margin increase. Cetaphil Gentle Cleanser, Drunk Elephant Vitamin C Serum, and Bioderma Sensibio H2O are predicted to experience a decline in sales volume following the price and margin increases.

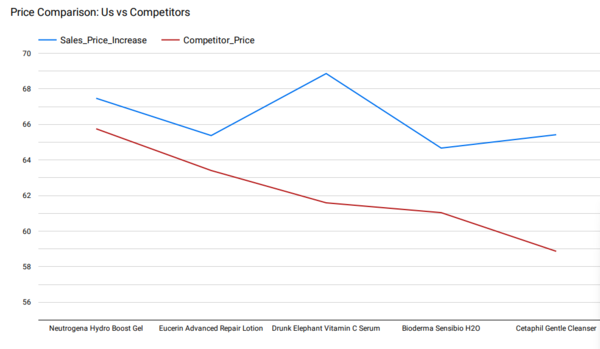

Price Comparison with Competitors

After a 10% price increase, all top five products would be priced higher than competitors, necessitating caution when implementing price hikes to avoid reducing competitiveness.

Visualization

Explore the complete interactive visualization here:

Key Insights

- Neutrogena Hydro Boost Gel and Eucerin Advanced Repair Lotion are strong candidates for price and margin increases, as they can maintain or increase sales despite higher prices.

- Cetaphil Gentle Cleanser and Bioderma Sensibio H2O are more price-sensitive and may require a more cautious pricing approach.

Strategic Recommendations

- Price Increase Feasibility: Focus on raising prices for Neutrogena Hydro Boost Gel and Eucerin Advanced Repair Lotion, which can sustain higher prices without sacrificing sales volume.

- Competitor Awareness: Given that all products would be priced higher than competitors after a price increase, maintain competitive awareness and potentially limit price hikes for more price-sensitive products.

- Margin Optimization: Consider margin increases for the top products to boost profitability without significantly affecting sales volume.

Conclusion

The model demonstrates that Neutrogena Hydro Boost Gel and Eucerin Advanced Repair Lotion are prime candidates for price and margin increases, offering opportunities for enhanced profitability. However, other products require a more nuanced strategy to avoid adverse impacts on demand.