30,000+

Customer Reviews

Analyzed across multiple e-commerce platforms and regions

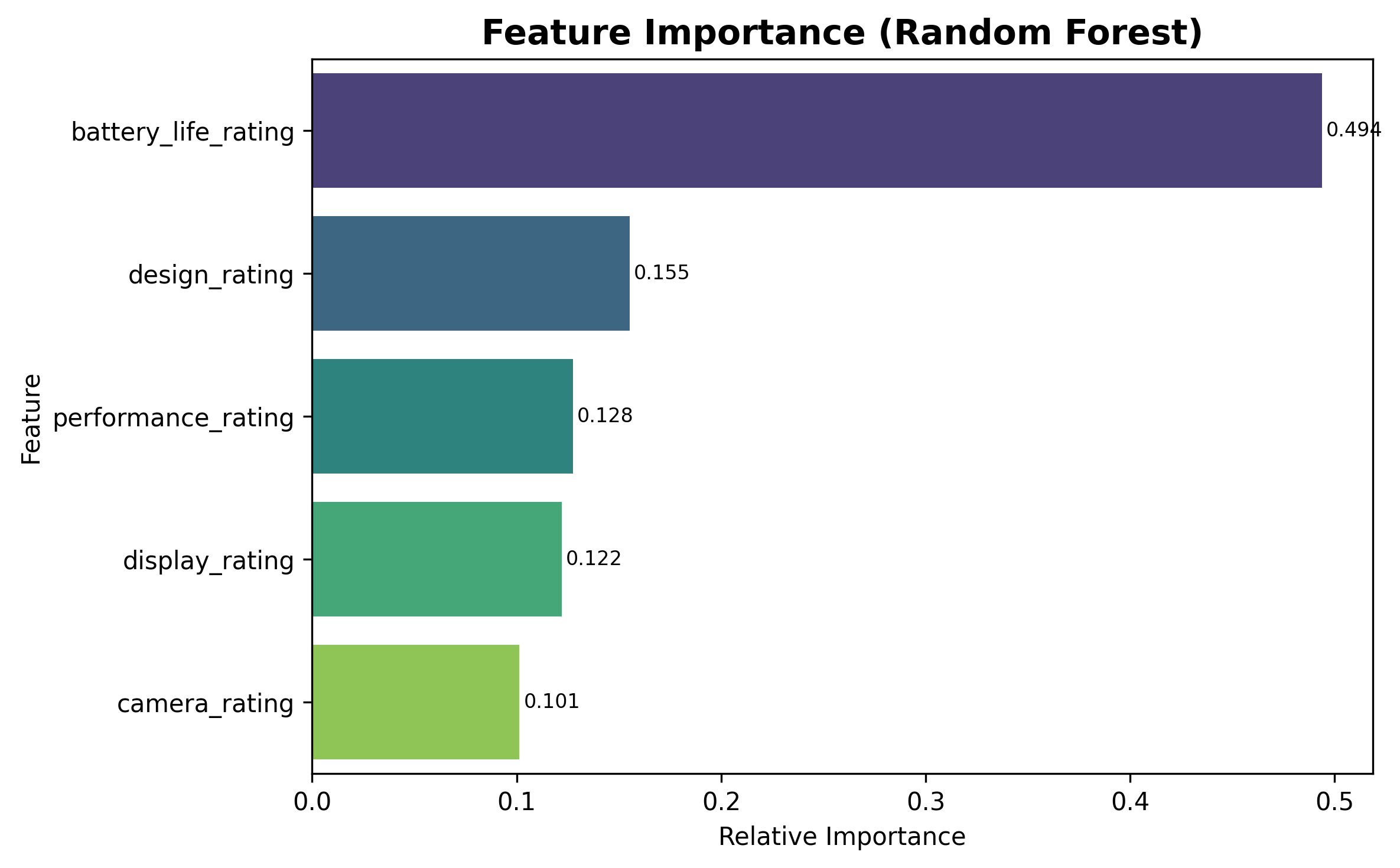

Battery

#1 Feature Driver

Battery life has the greatest impact on customer satisfaction

50-59

Top Age Group

Ages 50-59 give the most positive reviews and highest ratings

8

Countries

Consistent sentiment across India, Brazil, UAE, Australia, Germany, UK, Canada, USA

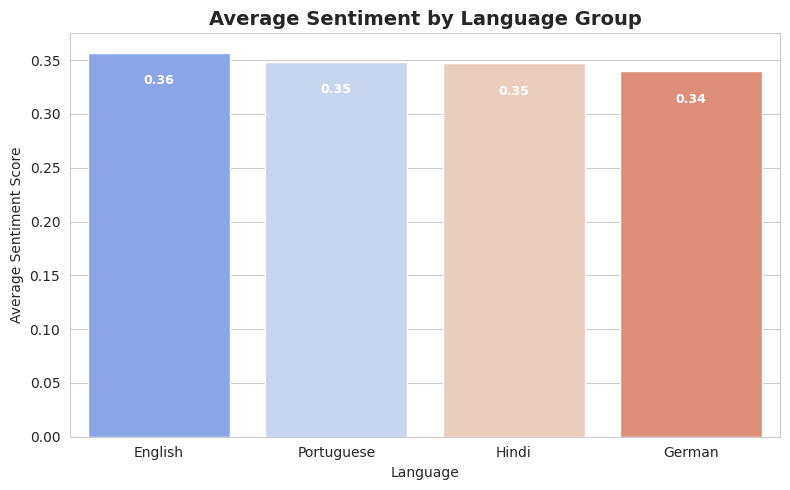

4

Languages

English, Portuguese, Hindi, German reviews analyzed

Top 3

Leading Brands

Apple, Samsung, and Realme deliver highest satisfaction

Data Sources and Methodology

Data Collection

Over 30,000 customer reviews from multiple e-commerce platforms including Aliexpress, Amazon, Bestbuy, and Flipkart. Reviews span Q4 2025 across 8 countries and 4 languages.

Quantitative Analysis

Statistical methods including averages, correlations, regression analysis, and machine learning models to identify feature impact and satisfaction drivers.

Qualitative Analysis

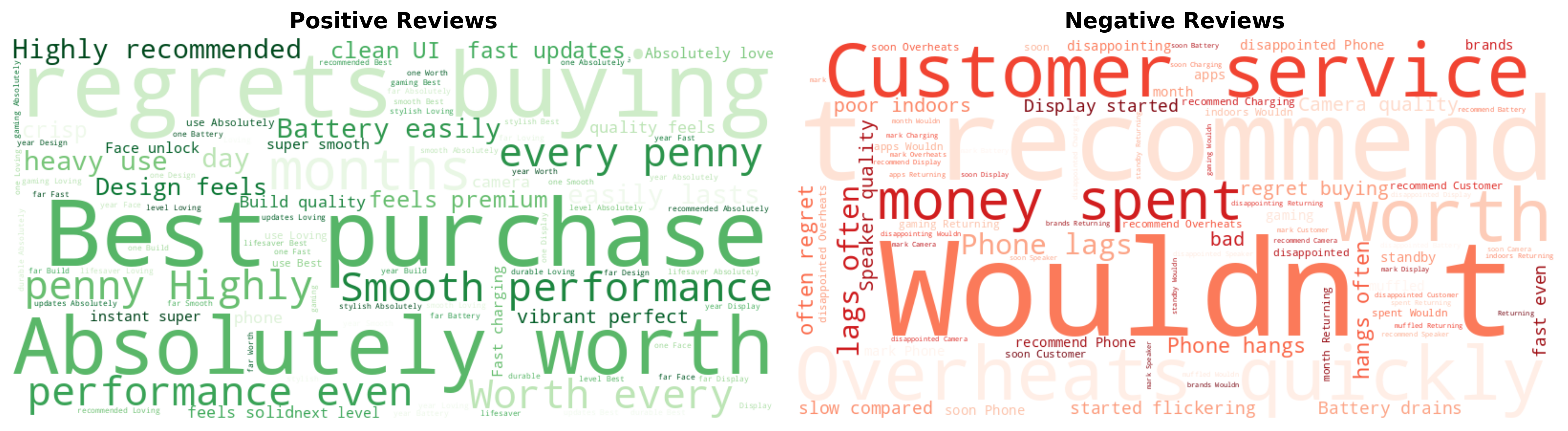

Sentiment scoring and keyword mapping of review text to identify recurring themes, emotional tone, and customer pain points across brands.

Customer Satisfaction Insights

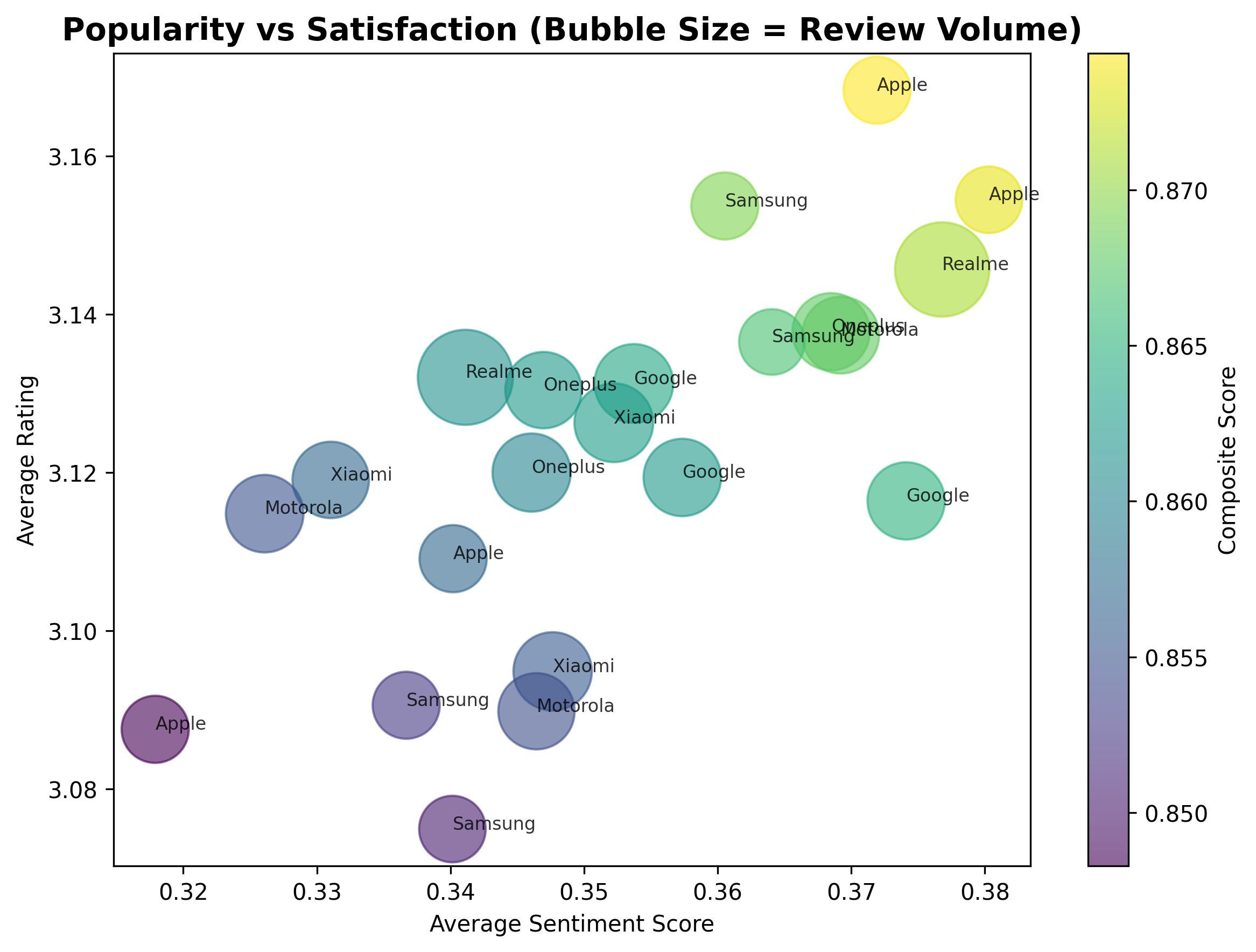

Q1: Brand Performance Leaders

Apple, Samsung, and Realme lead the market with highest customer satisfaction scores. Positive reviews highlight "smooth performance" and "worth every penny," while negative feedback focuses on "customer service" and "overheating" issues. Motorola and Xiaomi lag behind with reliability and service concerns.

Q2: Battery Life Drives Satisfaction

Battery life has the greatest impact on customer satisfaction, followed by design and performance. Camera quality plays a smaller role than expected. Customers reward phones that perform well over time and look refined. Marketing should emphasize "all-day battery life" and "reliable performance" rather than camera specifications.

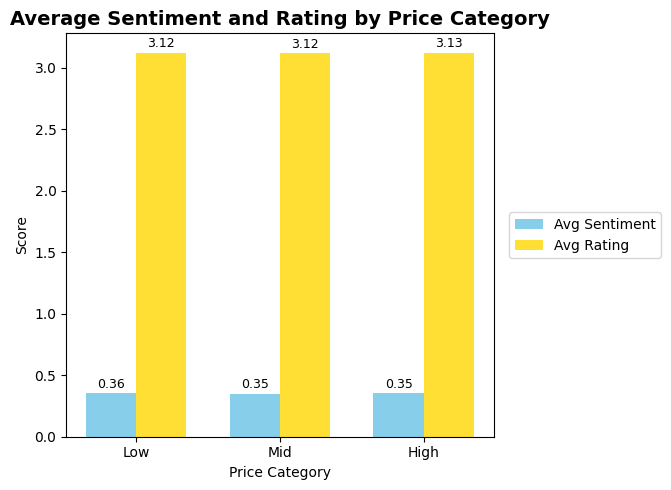

Q3: Value Perception Over Price

Satisfaction levels are consistent across all price categories – high or low cost doesn't predict happiness. Customers judge value based on how well the phone meets expectations, not how much they spent. The key insight: satisfaction is value-based, not price-based. Customers want fairness when the experience matches the price.

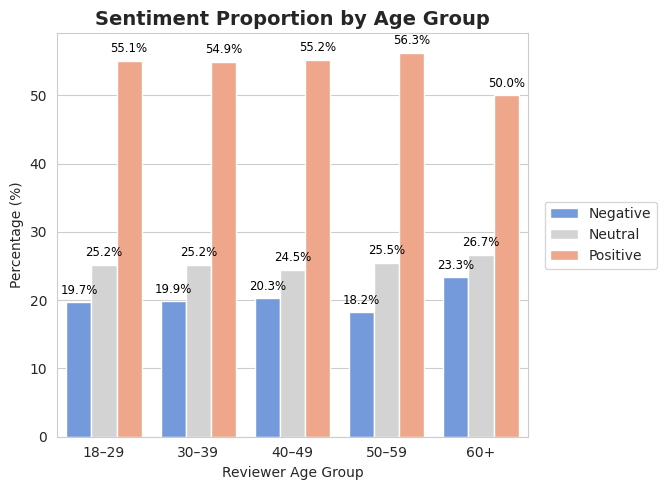

Q4: Age Demographic Patterns

Customers aged 50–59 give the most positive feedback with highest ratings. Younger groups (18–49) are more critical and innovation-focused, while those over 60 need clearer communication and support. Marketing can adapt by using innovation-driven campaigns for younger audiences and assurance-based messaging for older groups.

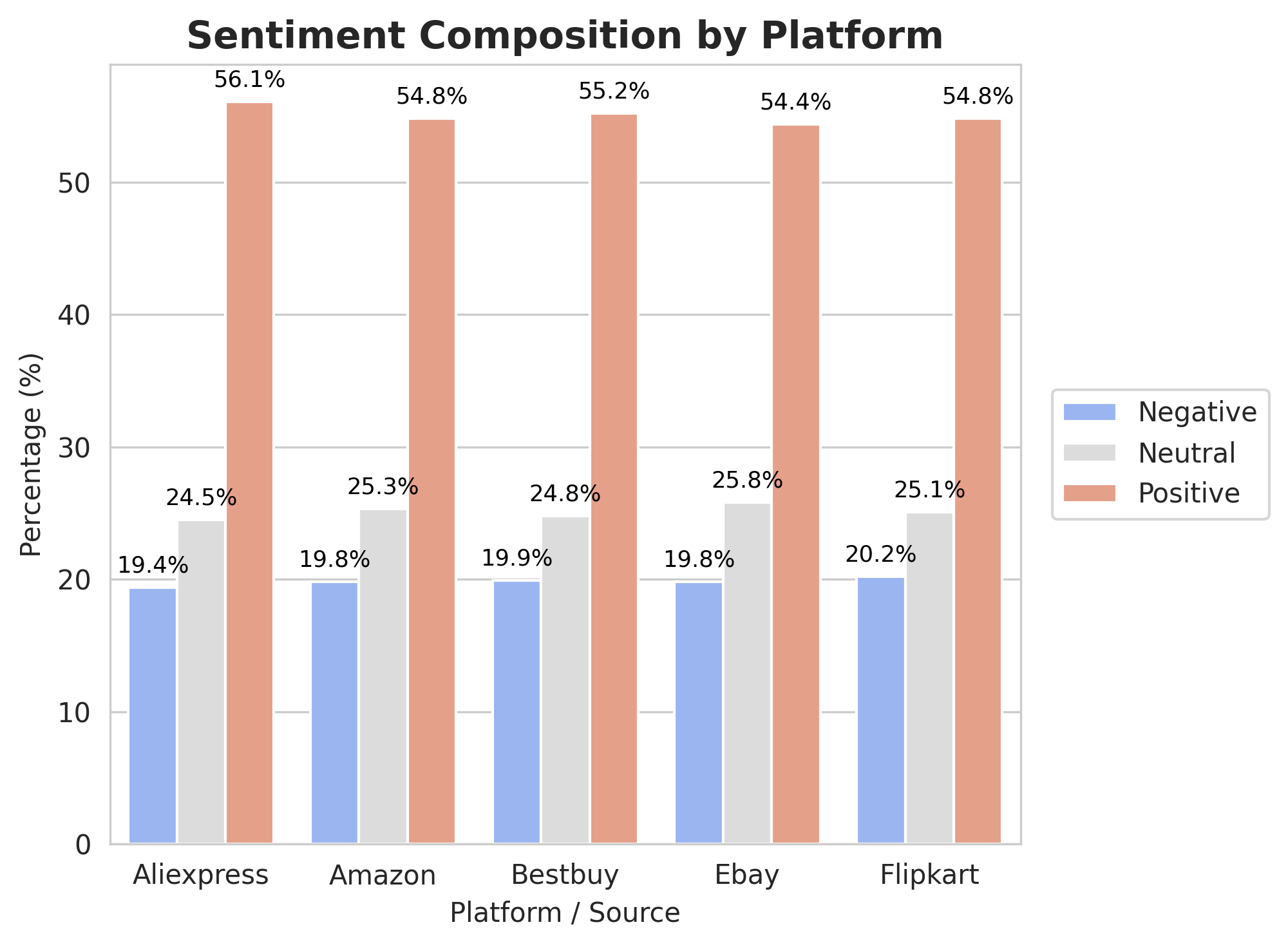

Q5: Platform Audience Differences

Ratings are steady across all major platforms at around three stars, but tone differs slightly. Aliexpress buyers are more upbeat while Bestbuy reviewers are more demanding. Campaigns on Aliexpress and Flipkart should highlight affordability and value, while Amazon and Bestbuy campaigns should focus on reliability and service quality.

Q6: Global Sentiment Consistency

Customer sentiment is stable across both languages and countries. Differences between English, Portuguese, Hindi, and German reviews are minimal. Sentiment across 8 regions remains highly consistent for all major brands. This stability allows for unified global marketing messages with only minor local adjustments.