Beyond the Price Tag

What Drives Customer Satisfaction in Smartphones

Overview

This analysis helps the marketing team understand how customers feel about different smartphone brands and models. It looks at what makes people satisfied or disappointed – such as battery life, design, or value for money – and compares how sentiment differs across regions, languages, and shopping platforms.

The goal is to use these insights to guide marketing decisions: which brands to promote, what product qualities to highlight, where to focus ad budgets, and how to respond to negative feedback. In short, this study turns customer reviews into practical insights that help shape better campaigns and stronger brand messages.

Data Sources and Methodology

This analysis draws from over 30,000 customer reviews collected across multiple e-commerce platforms, regions, and languages. Each record includes product details such as brand, model, and price, along with ratings, feature evaluations, and written feedback. Demographic information, including age group and purchase source, was also considered to understand how different users perceive and rate their phones.

We used both numbers and text to understand customer sentiment. Quantitative analysis included averages, correlations, and regression to find patterns and measure how features like battery life or design affect satisfaction. Machine learning models were applied to identify the most influential features. Qualitative analysis focused on review text to identify recurring themes and emotional tone using sentiment scoring and keyword mapping.

The data represents reviews from the most recent quarter of 2025. Results were compared across brands, models, platforms, and countries to uncover what customers value most and where brands need improvement. This mixed-method approach helps translate customer feedback into clear insights that guide marketing strategy, brand positioning, and campaign planning.

1. Which brand and model are well received by the market, and which are least popular?

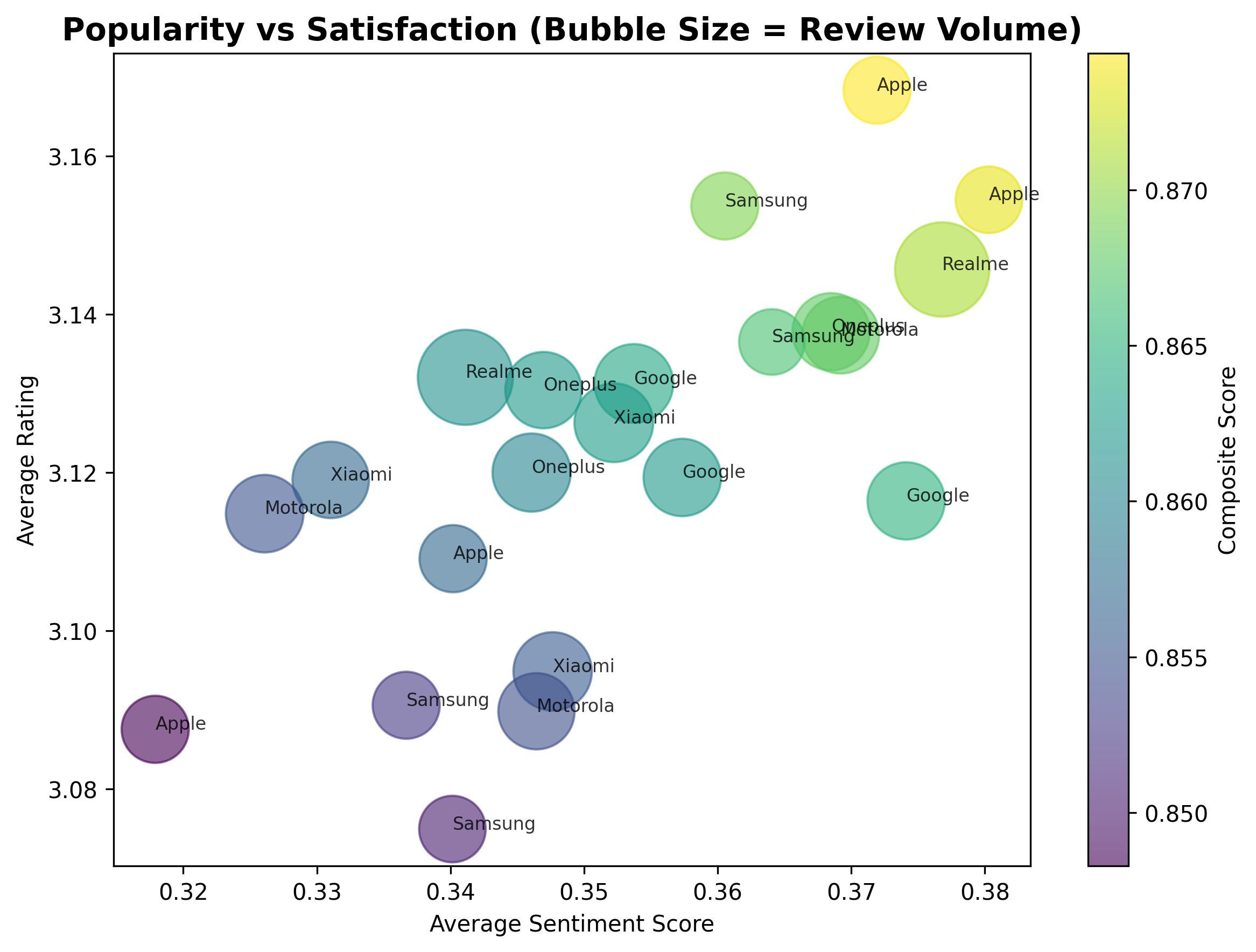

Apple and Samsung receive the strongest customer approval, combining high sentiment and high ratings. Realme performs well too, offering strong satisfaction at mid-range prices and standing out for its value-for-money image. Google and OnePlus maintain a stable reputation but need consistent brand communication to strengthen trust. Motorola and Xiaomi lag behind, showing lower satisfaction tied to reliability and service issues.

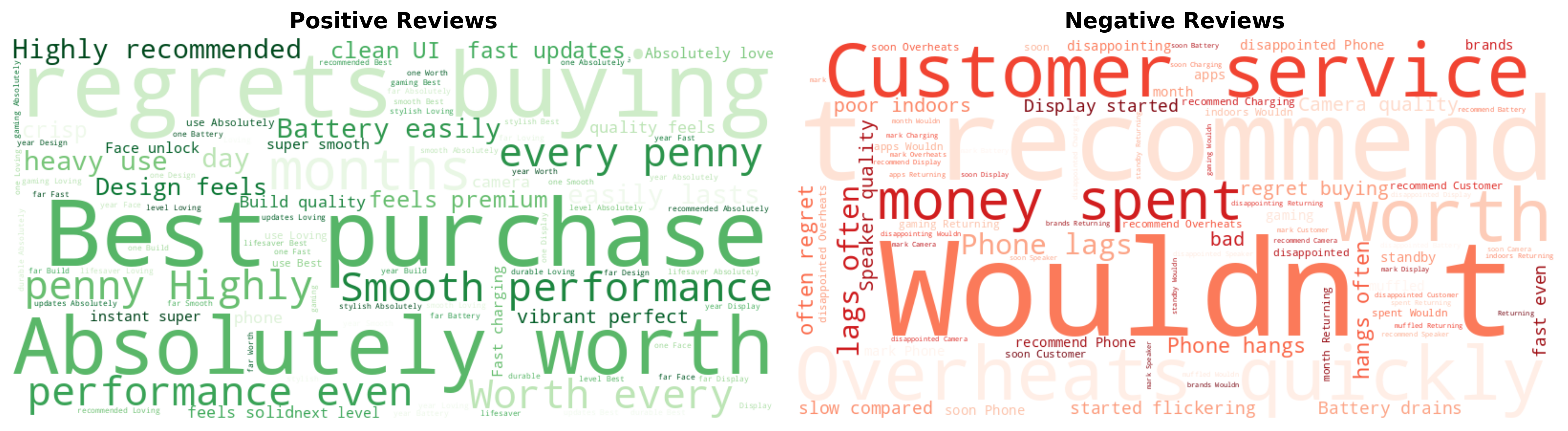

Positive reviews highlight "smooth performance" and "worth every penny," while negative ones mention "customer service" and "overheating." This shows that reliability, performance, and support matter more to customers than features alone. Overall, Apple, Samsung, and Realme lead the market in brand perception, while Motorola and Xiaomi must rebuild credibility through better after-sales experiences.

2. What phone features make a model well received?

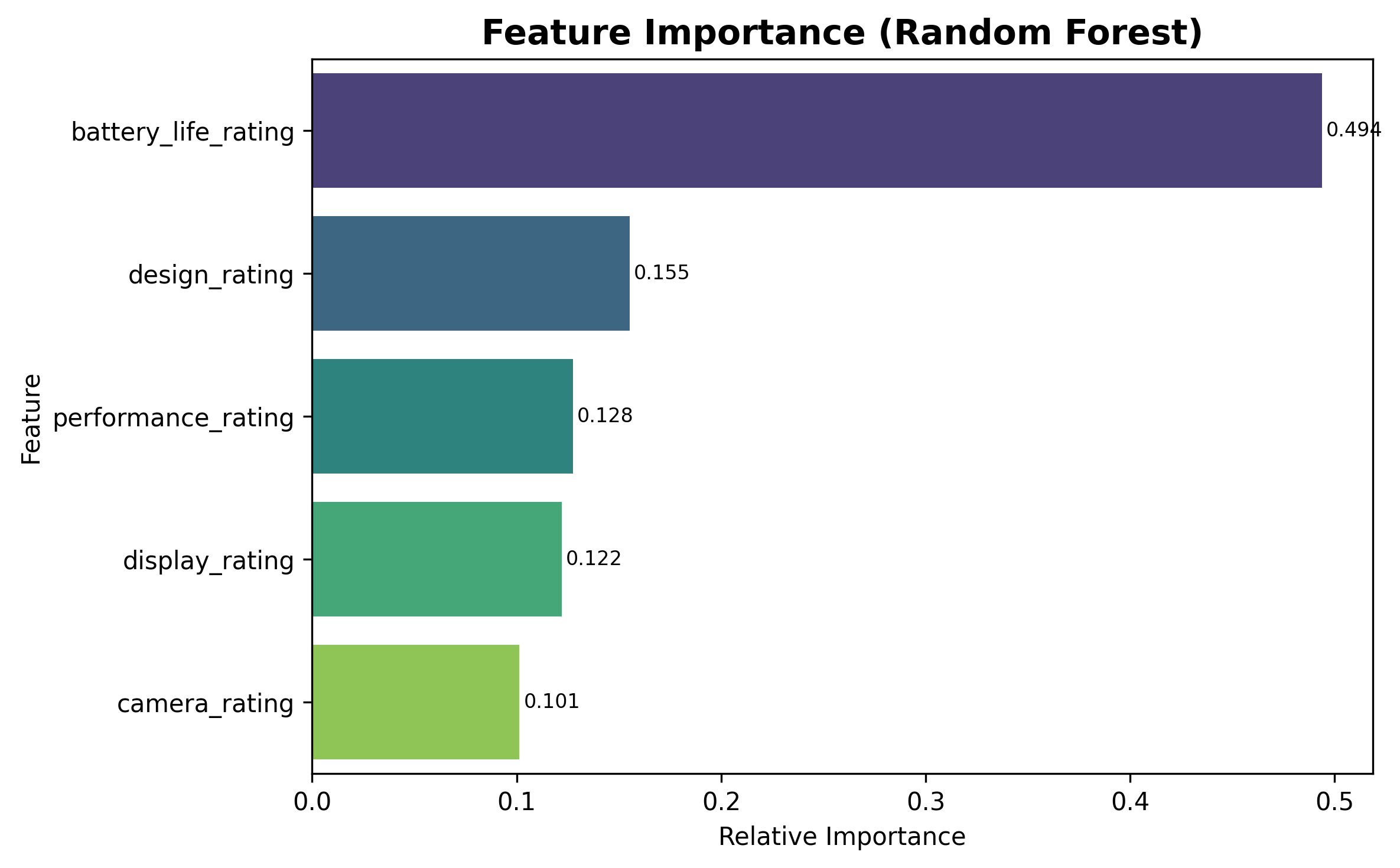

Battery life has the greatest impact on customer satisfaction, followed by design and performance. Users consistently link long-lasting power and durable design with positive emotions, while the camera plays a smaller role. Apple leads in design and display quality, Realme in battery strength, and OnePlus in overall balance, showing that dependability and everyday usability matter more than technical specs.

Customers clearly reward phones that perform well over time and look refined. Marketing messages should focus on "all-day battery life" and "reliable performance" rather than overemphasizing camera pixels. Brands that invest in endurance and build quality will see stronger emotional connection and reputation growth.

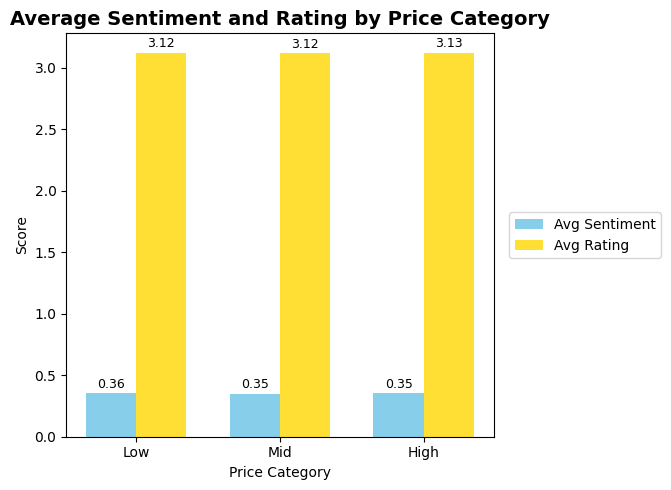

3. How do price and value perception affect customer satisfaction?

Satisfaction levels are consistent across all price categories – high or low cost doesn't predict happiness. Customers judge value based on how well the phone meets expectations, not how much they spent. Budget models show more mixed reactions, while premium buyers demand reliability and consistency.

The key insight is that satisfaction is value-based, not price-based. Customers want fairness – they feel positive when the experience matches the price. Marketing should focus on "worth the spend" and real-world reliability rather than price comparisons, using relatable user stories to reinforce perceived value.

4. Who is more likely to give good reviews, and does age play a factor?

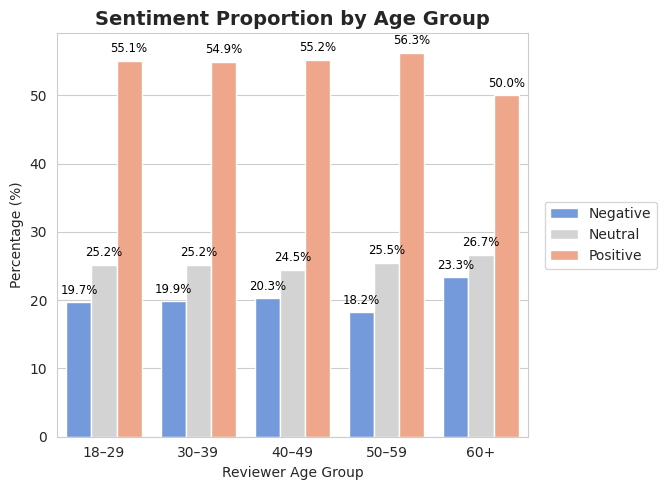

Age affects how people review phones. Customers aged 50–59 give the most positive feedback, with the highest ratings and sentiment. Younger groups (18–49) are more critical and focus on innovation, while those over 60 express lower satisfaction and need clearer communication and support.

As people age, their ratings improve slightly, showing that middle-aged users value practicality and trust, while younger buyers seek novelty. Marketing can adapt by using innovation-driven campaigns for younger audiences and assurance-based messaging for older groups. Testimonials from the 50–59 segment can be powerful tools for credibility and brand loyalty.

5. Does where the buyer gets the phone influence the review rating for the same model?

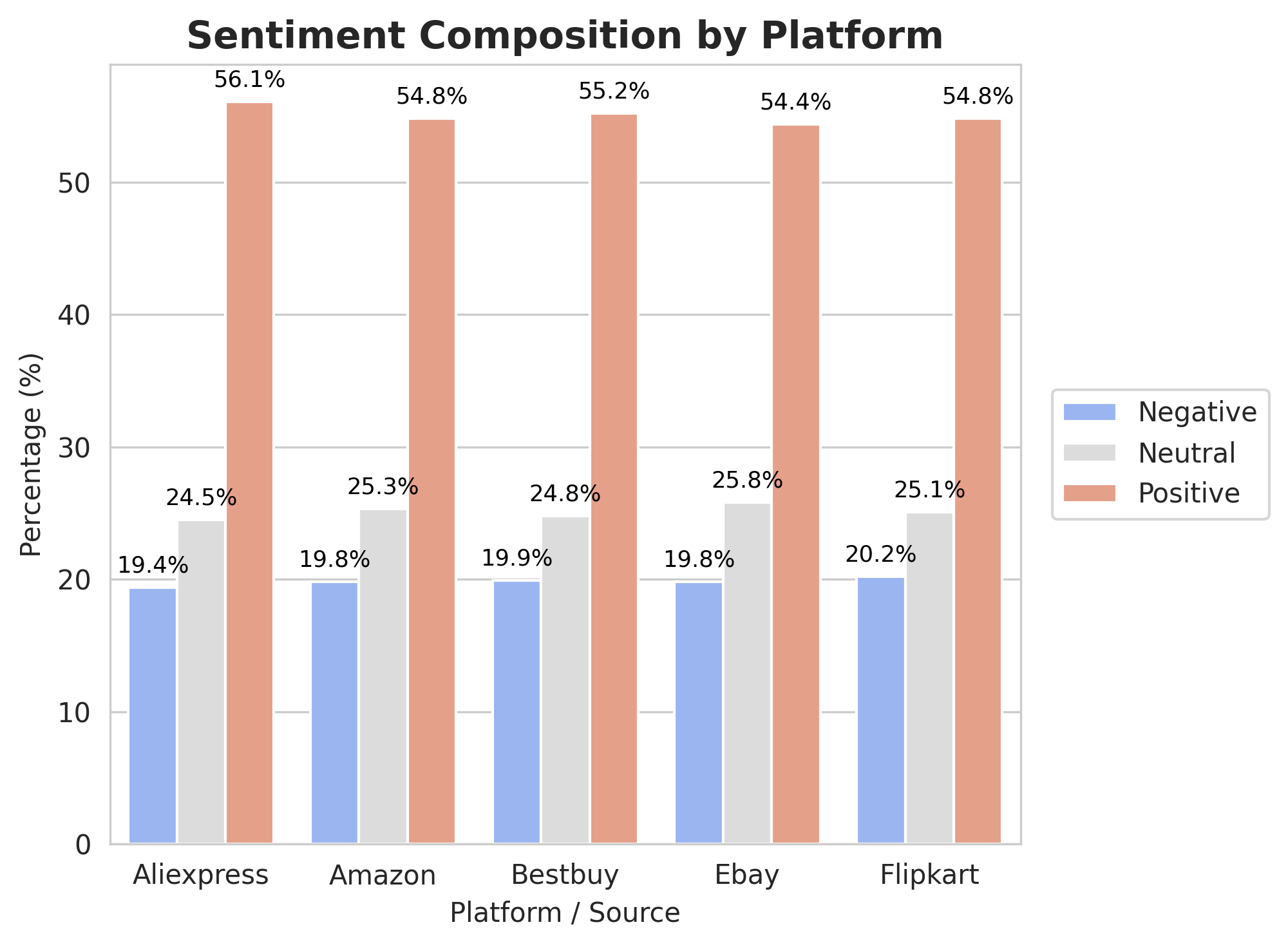

Ratings are steady across all major platforms, with average scores around three stars, showing that the buying platform has little effect on satisfaction. Positive sentiment dominates everywhere, though tone differs slightly – Aliexpress buyers are more upbeat, while Bestbuy reviewers are more demanding.

These differences suggest that platform audiences shape expectations. Campaigns on Aliexpress and Flipkart should highlight affordability and value, while those on Bestbuy and Amazon should focus on product reliability and service quality. Tailoring tone to each platform's audience will help maintain consistent brand sentiment and trust.

6. How consistent is brand sentiment across different regions and languages?

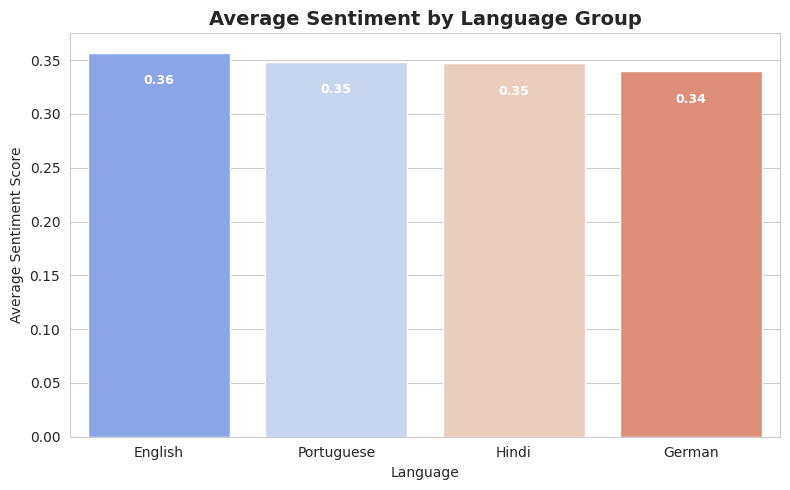

Customer sentiment is stable across both languages and countries. Differences in sentiment scores between English, Portuguese, Hindi, and German reviews are minimal, showing that emotional tone and satisfaction translate well across cultures. Similarly, sentiment across regions – including India, Brazil, the UAE, Australia, Germany, the UK, Canada, and the USA – remains highly consistent for all major brands.

This stability means customers perceive brands similarly worldwide. Marketing teams can maintain a unified global message focused on reliability and satisfaction, adjusting tone slightly for local preferences. Strong consistency across markets signals high brand trust and gives marketers confidence to scale campaigns globally without losing authenticity.

Conclusion

Apple, Samsung, and Realme should lead upcoming campaigns, as they deliver the highest satisfaction and engagement. Motorola and Xiaomi need repositioning and stronger post-purchase support before re-entering major promotions. Campaigns should highlight practical benefits – long battery life, reliability, and premium design – rather than technical specifications.

Ad budgets should follow sentiment patterns: emphasize affordability on Aliexpress and Flipkart, and service quality on Amazon and Bestbuy. Because sentiment is consistent worldwide, a unified global campaign can be effective with small cultural adjustments. Negative sentiment, often about service or overheating, should be addressed openly with clear communication and engagement initiatives that demonstrate responsiveness and build trust.

Marketing Recommendations

- Promote: Apple, Samsung, and Realme – these brands show the highest customer satisfaction and should receive priority in marketing budgets.

- Rebuild: Motorola and Xiaomi need improved after-sales service and reliability messaging before large-scale campaigns.

- Message Focus: Emphasize "all-day battery life," "reliable performance," and "worth the spend" rather than technical specifications.

- Platform Strategy: Tailor campaigns by platform – affordability messaging on Aliexpress/Flipkart, reliability on Amazon/Bestbuy.

- Age Segmentation: Use innovation-driven campaigns for ages 18–49, assurance-based messaging for ages 50+.

- Global Consistency: Leverage sentiment stability across regions for unified global campaigns with minor local adjustments.

- Address Negativity: Proactively communicate about service improvements and overheating solutions to build trust.

Final Note

Customer satisfaction in smartphones is driven by practical, everyday factors like battery life, reliability, and value perception – not just by the latest features or lowest prices. Marketing that focuses on these core drivers, tailored to the right audience on the right platform, will create stronger emotional connections and drive better business outcomes.